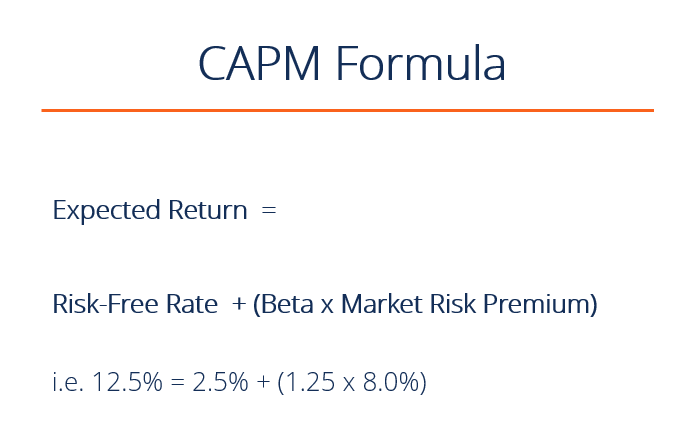

The Capital Asset Pricing Model (CAPM) is a model that describes the relationship between the expected return and risk of investing in a security. It shows that the expected return on a security is equal to the risk-free return plus a risk premium, which is based on the beta of that security. Below is an illustration of the CAPM concept.

CAPM Formula and Calculation

CAPM is calculated according to the following formula:

Where:

Ra = Expected return on a security

Rrf = Risk-free rate

Ba = Beta of the security

Rm = Expected return of the market

Note: “Risk Premium” = (Rm – Rrf)

The CAPM formula is used for calculating the expected returns of an asset. It is based on the idea of systematic risk (otherwise known as non-diversifiable risk) that investors need to be compensated for in the form of a risk premium. A risk premium is a rate of return greater than the risk-free rate. When investing, investors desire a higher risk premium when taking on more risky investments.

Expected Return

The “Ra” notation above represents the expected return of a capital asset over time, given all of the other variables in the equation. “Expected return” is a long-term assumption about how an investment will play out over its entire life.

Risk-Free Rate

The “Rrf” notation is for the risk-free rate, which is typically equal to the yield on a 10-year US government bond. The risk-free rate should correspond to the country where the investment is being made, and the maturity of the bond should match the time horizon of the investment. Professional convention, however, is to typically use the 10-year rate no matter what, because it’s the most heavily quoted and most liquid bond.

To learn more, check out CFI’s Fixed-Income Fundamentals Course.

Beta

The beta (denoted as “Ba” in the CAPM formula) is a measure of a stock’s risk (volatility of returns) reflected by measuring the fluctuation of its price changes relative to the overall market. In other words, it is the stock’s sensitivity to market risk. For instance, if a company’s beta is equal to 1.5 the security has 150% of the volatility of the market average. However, if the beta is equal to 1, the expected return on a security is equal to the average market return. A beta of -1 means security has a perfect negative correlation with the market.

To learn more: read about asset beta vs equity beta.

Market Risk Premium

From the above components of CAPM, we can simplify the formula to reduce “expected return of the market minus the risk-free rate” to be simply the “market risk premium”. The market risk premium represents the additional return over and above the risk-free rate, which is required to compensate investors for investing in a riskier asset class. Put another way, the more volatile a market or an asset class is, the higher the market risk premium will be.

Video Explanation of CAPM

Below is a short video explanation of how the Capital Asset Pricing Model works and its importance for financial modeling and valuation in corporate finance. To learn more, check out CFI’s Financial Analyst Courses.

0 Comments:

Post a Comment